Rising vaccination rates and decreasing infection rates across several European countries have helped the Travel app category hit strong year-over-year growth rates in Q2 2021, with downloads up 104 percent. Sensor Tower’s latest report, available now, reveals that downloads reached 143 million installs, up 14 percent versus H1 2020 on Google Play and Apple’s App Store, respectively. Our report covers four main sub-genres, including travel aggregator, accommodation, transportation, and urban travel apps.

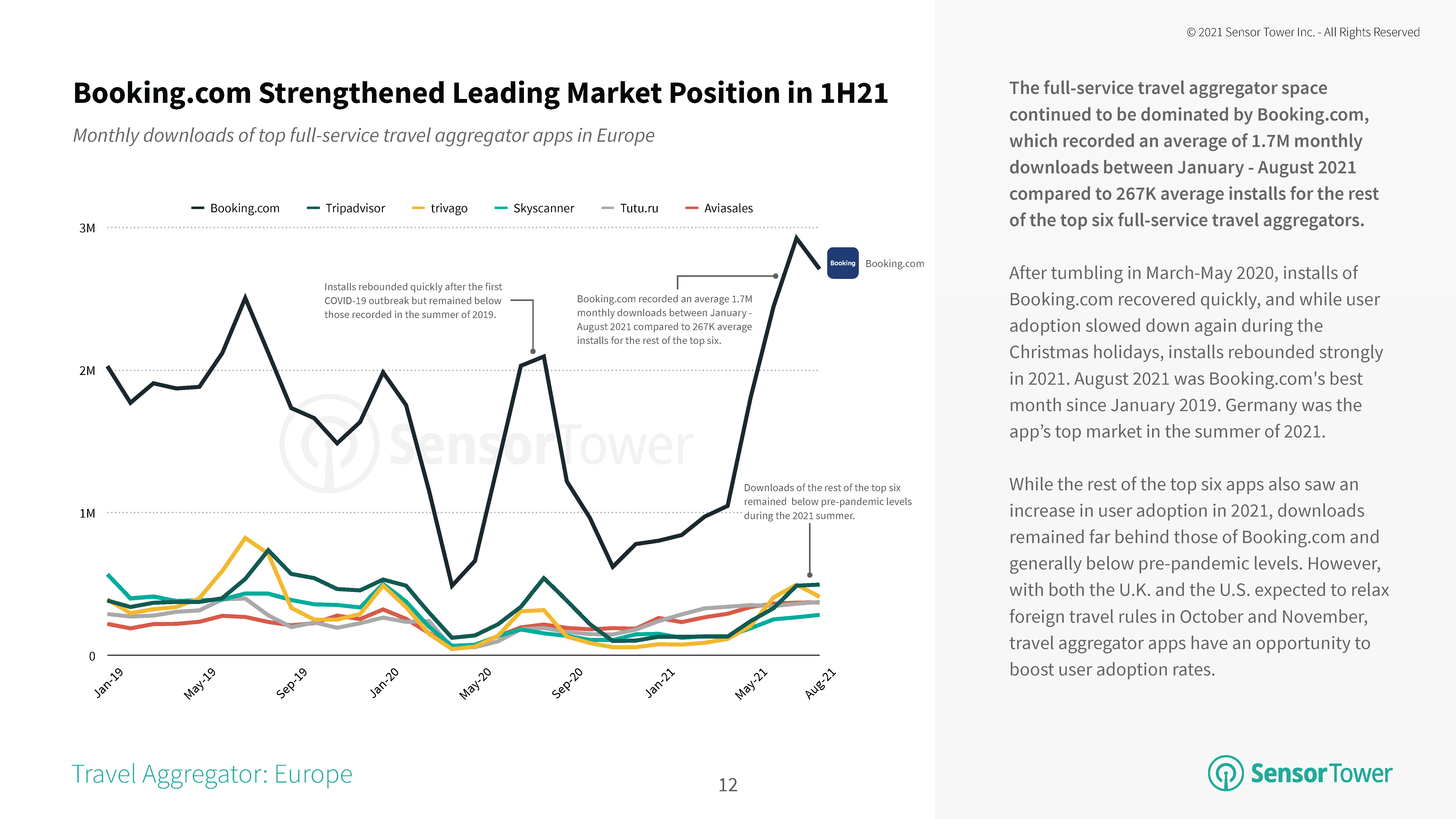

Booking.com Dominates the Travel Aggregator Space

Travel aggregator apps were significantly impacted by the emergence of COVID-19. However, by the summer of 2021, downloads of hotel booking apps and full-service travel aggregators were approaching pre-pandemic levels. Booking.com reached nearly 3 million downloads in Europe in July 2021, a new all-time high exceeding its peaks during the summer months before the pandemic. From January to August 2021, Booking.com saw an average of 1.7 million downloads per month compared to competitors Tripadvisor, Trivago, Skyscanner, Tutu.ru, and Aviasales, which collectively saw 267,000 average installs per month. With the United Kingdom and the United States expected to relax foreign travel restrictions in the coming months, travel aggregator apps have an opportunity to continue boosting user adoption rates.

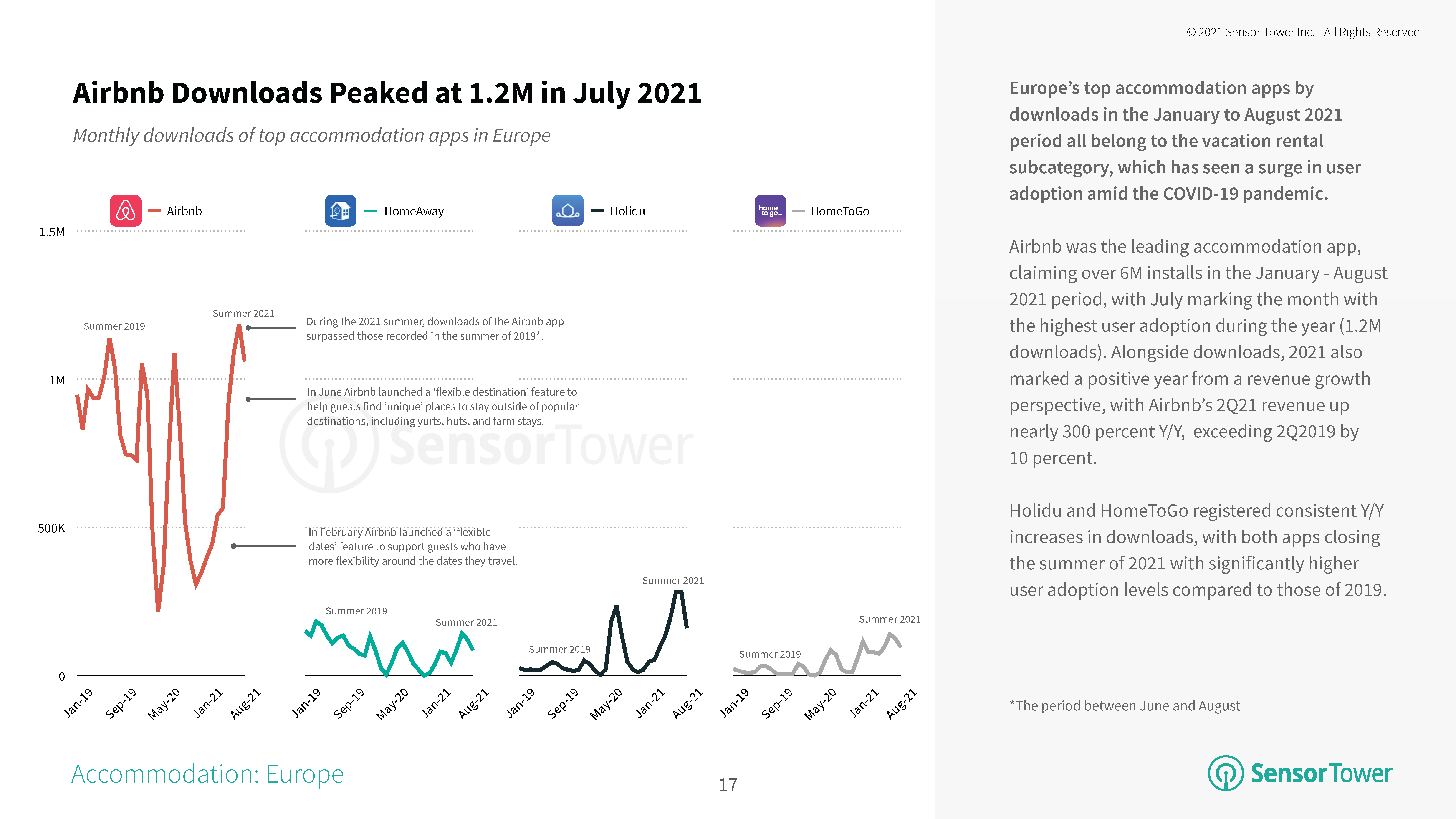

Airbnb Downloads Surpass Those Recorded in the Summer of 2019

Vacation rental apps led the accommodation category recovery in the summer of 2021. Airbnb was the top accommodation app, surpassing 6 million installs between January to August 2021, with user adoption reaching its highest point during the year in July at 1.2 million downloads.

Other accommodation apps such as HomeAway, Holidu, and HomeToGo registered consistent Y/Y increases in downloads with significantly higher user adoption levels compared to summer 2019.

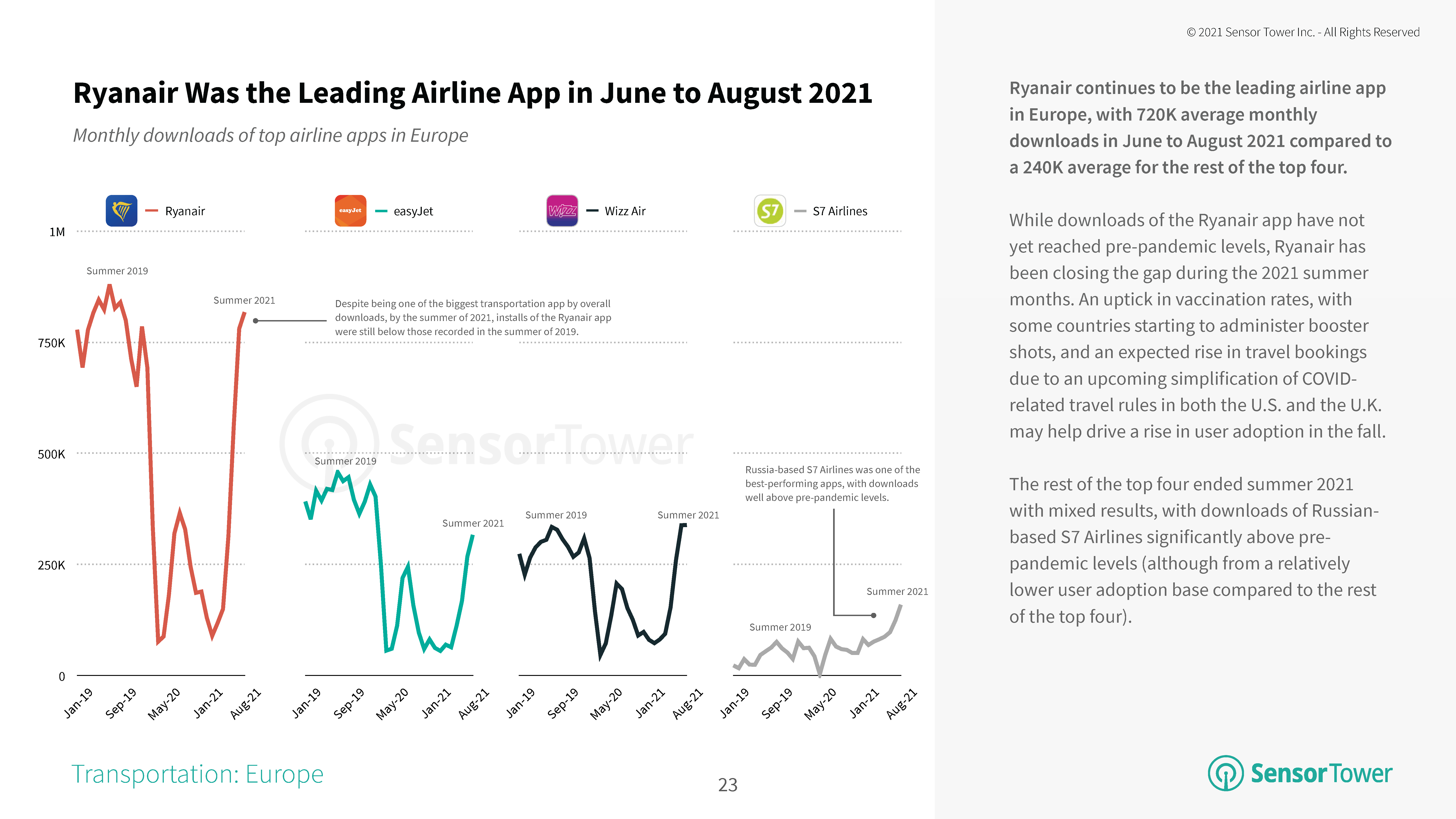

Ryanair Downloads Took Off This Summer

In Europe, Ryanair was the leading airline app, with 720,000 average monthly downloads from June to August 2021 compared to an average of 240,000 monthly downloads for easyJet, Wizz Air, and S7 Airlines. Ryanair ranked No. 1 by downloads in 18 out of the 32 months between January 2019 and August 2021. Of the four top airline apps in Europe, Russia-based S7 Airlines saw the most Y/Y growth, with downloads well above pre-pandemic levels in the summer of 2021.

For more analysis from the Sensor Tower Store Intelligence platform, including key insights on travel apps in Europe, download the complete report in PDF form below: