Sensor Tower’s new report on COVID-19’s impact on the app ecosystem, available now, reveals that the pandemic has had lasting effects on the mobile space. Categories such as Business flourished, while trends in other categories—such as the Hypercasual genre in mobile games—were interrupted as consumer habits shifted. This analysis takes a deeper look at the near-term effects as the mobile landscape continues to evolve to suit the needs of mobile users.

Top U.S. Business Apps Are Experiencing Continued Lift

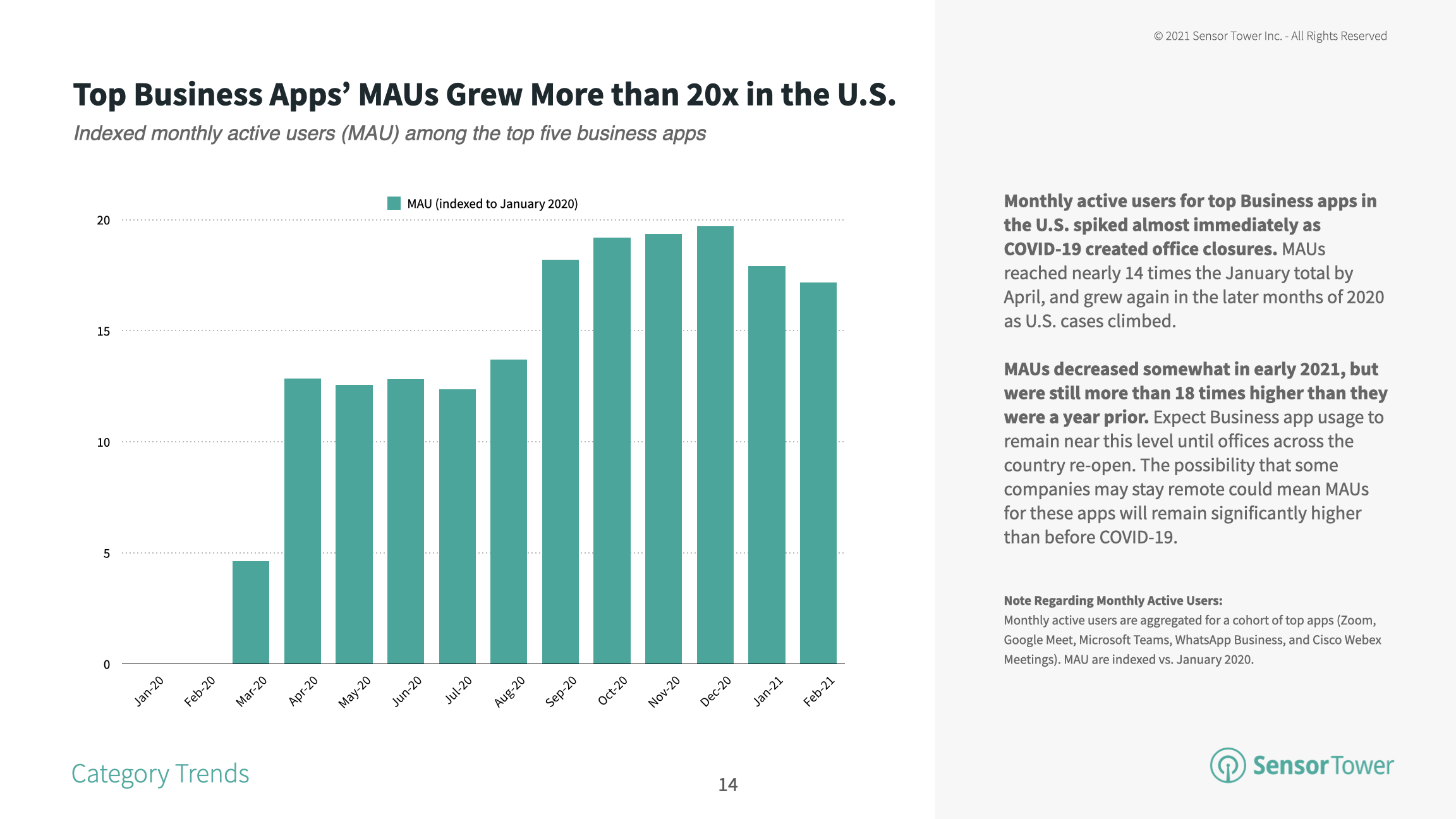

The Business category flourished in 2020 as consumers turned to mobile devices for remote work. As in-person offices closed, the monthly active users of the top business apps in the United States spiked.

In April 2020, top Business category apps saw their combined U.S. MAU grow to nearly 14 times January 2020’s total. As parts of the U.S. have begun to open with limited capacity in early 2021, this surge of monthly users has somewhat abated. However, average MAUs for these apps are still more than 18 times higher than they were a year ago in the first two months of 2021.

Top Sports Apps See a Rebound

Before the pandemic, ESPN and DAZN were the top two sports apps, experiencing rapid growth in revenue. However, along with other industries such as travel, sports was heavily impacted by COVID-19 as in-person events were shut down—and this affected the Sports category on mobile as well.

Growth for ESPN and DAZN was halted as the sports industry grappled with the pandemic, though revenue has begun to recover. This is particularly true for DAZN, which saw its best-ever quarter in Q4 2020 with more than $45 million in consumer spending thanks to growth in Europe and Japan. ESPN’s recovery has been slower, since more than 99 percent of its revenue comes from the U.S. and North America’s recovery has lagged behind other regions.

Hypercasual Game Downloads Took a Hit

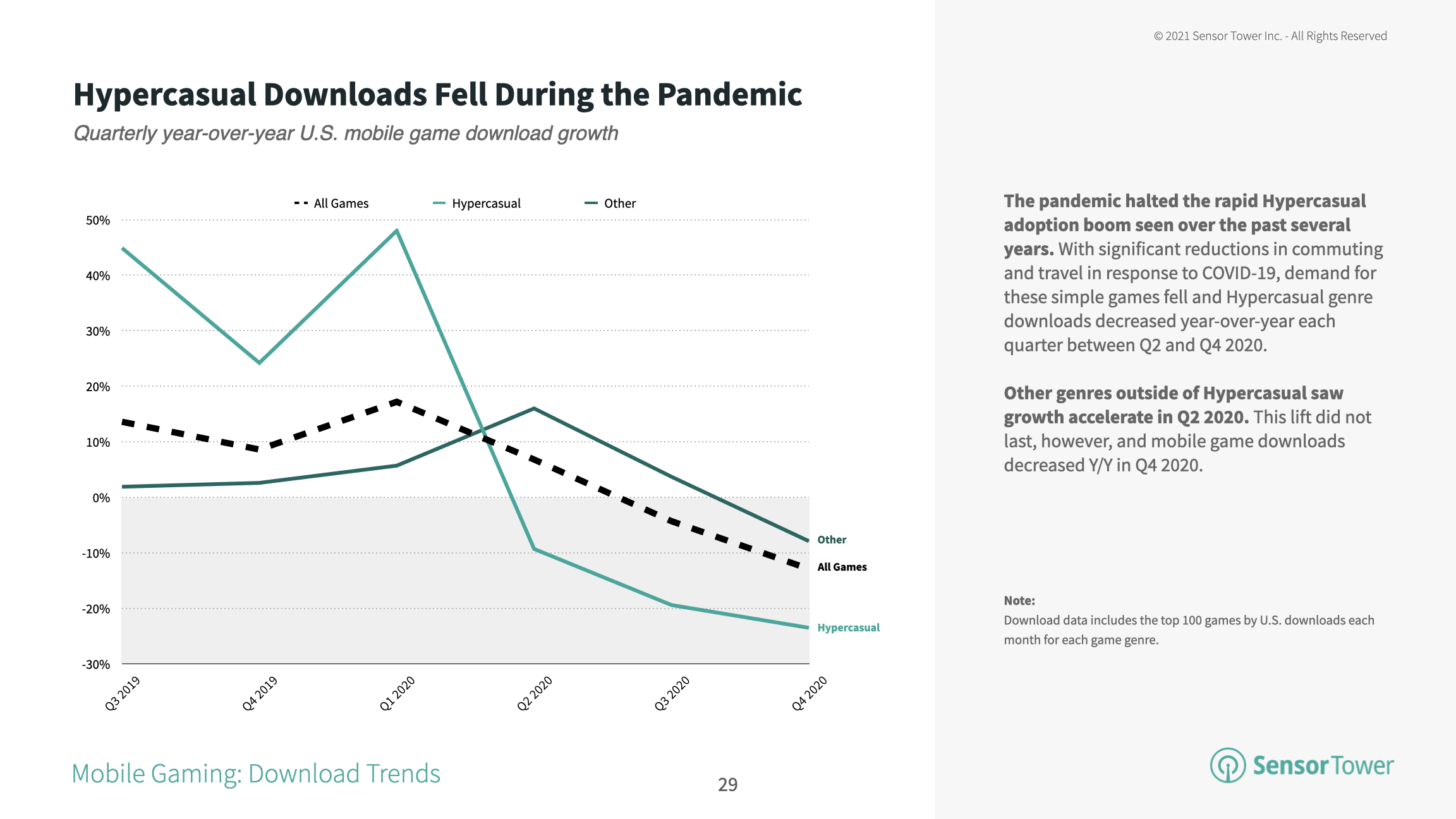

Although the Hypercasual genre remains one of the largest in mobile games, its rapid ascendancy was interrupted by COVID-19. As consumers sheltered in place and no longer commuted, U.S. installs of the top Hypercasual games declined over the course of 2020. At the start of last year, the genre represented eight out of the top 10 U.S. mobile games by downloads in Q1; by Q4, this share had fallen to five out of the top 10.

While the Hypercasual genre’s installs suffered from COVID-19, revenue for mobile games on the whole boomed during 2020. Worldwide consumer spending in games accelerated beginning in Q2, with year-over-year revenue growth peaking at nearly 40 percent in May 2020.

For more analysis from the Sensor Tower Store Intelligence platform, including key insights mobile app revenue trends by category during the pandemic in the U.S. and Europe along with an analysis of key apps, download the complete report in PDF form below: